Qualify an Inbound Lead

Say you're an analyst at a payment processing company for restaurants, cafes, specialty food and grocery stores. You receive a new inbound lead from your company's system with the following information:

Legal Name: Popupbagels Inc

Brand Name (DBA): Popup Bagels

Website: https://www.popupbagels.com

Email: info@popupbagels.com

With Enigma, you'll quickly be able to determine whether this is a qualified lead.

To get started, open the Enigma Console search page. You'll see the search bar at the top of the page. Enter the brand name and website into the corresponding search bar inputs. Look at the results and decide whether the correct match was returned.

In this case, only one search result was returned. You can confirm that the brand name and website (highlighted in blue), match the values you entered.

The search result card gives you some additional cotext on the brand:

- The brand is a bakery (or sub-category of bakeries)

- The brand has 9 operating locations (bottom left)

- The brand has >1,000 customer reviews from its 9 operating locations

- The brand has almost $5M in card revenue (spending by customers) across all locations and online

- The brand’s card revenue is increasing rapidly (year over year growth of >100%)

To learn more about the brand, and its potential value as an inbound lead, click on the search result and visit the brand’s profile page.

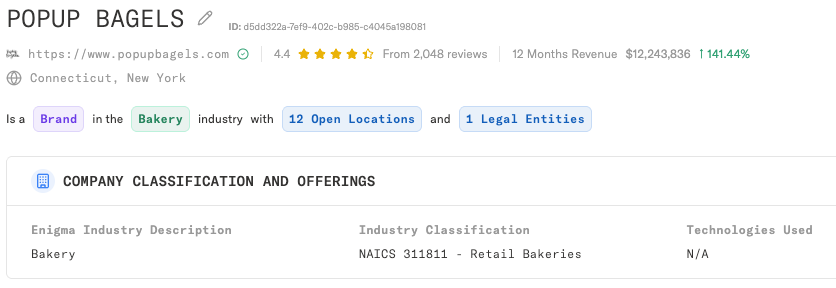

The brand page includes deatiled information about the identity and activity of the brand. It is doing business as a bakery - specifically a retail bakery - which makes it a potential buyer of your product. The average customer rating is 4.4 stars across >1,000 customer reviews at the 9 locations. So the brand is viewed favorably by customers who have visited the stores.

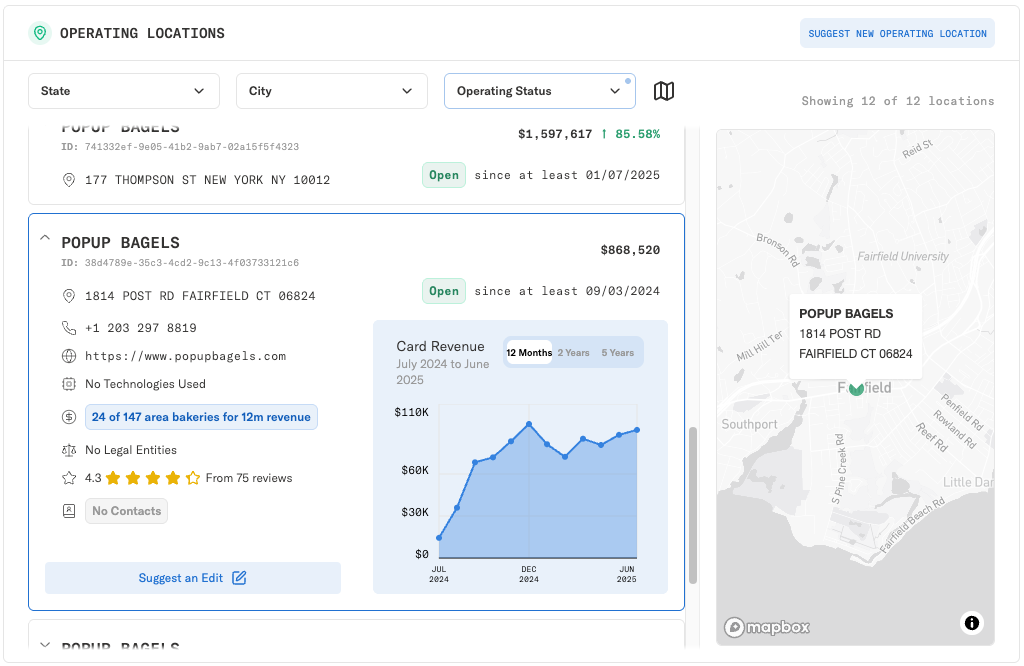

Looking more closely at the operating locations, we can see that many locations have opened within the last 1-3 years, and that revenue is growing at each of the locations:

This location in Fairfield, CT opened in mid 2024, and has monthly revenues of around $50-$100k in the last few months, totalling around $280k in revenue year to date.

Even though it has less than a year of revenue, the revenue during the last 12 months ($280k), it ranks 76th out of 138 area bakeries in card revenue!

It looks likely that this will be a high performing retail bakery in the area if card revenue continues at this level.

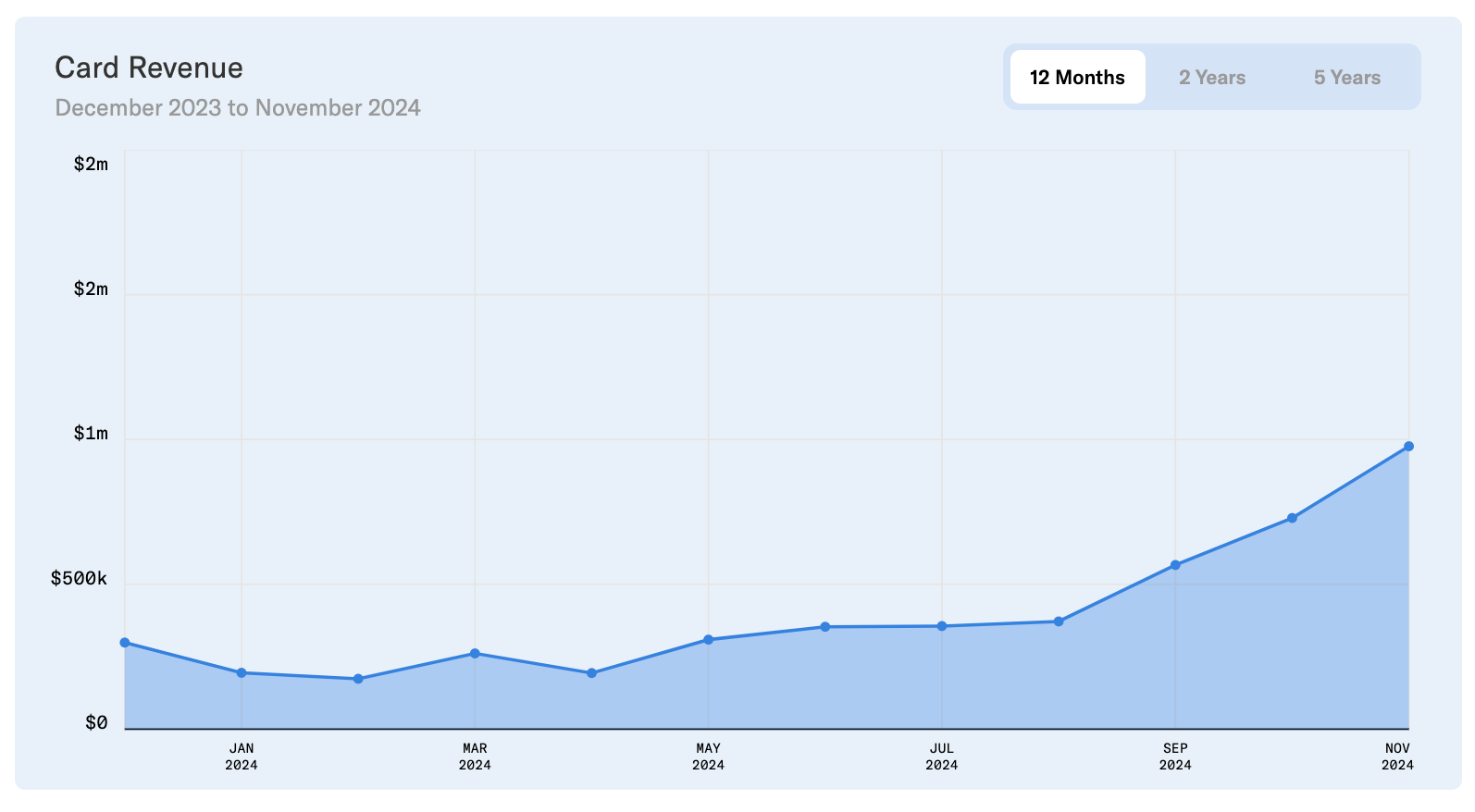

Card revenue at the brand overall, across all locations and online, is growing (as we saw in the initial search results):

Digging into the source of this growth, this is coming predominantly from an increase in the frequency of transactions (likely driven in part by store openings), while the average transaction size has actually decreased from >$40 in early 2024 to around $25 in mid 2024:

As a payment processor, this has the potential to be a high value lead since there are frequent, growing transactions across multiple stores, and the brand looks to be continuing its expansion. The brand itself is likely interested in negotiating better rates with a processor that recognizes the increasing frequency of transactions, and that is able to provide a robust service.

Armed with this information your sales team can estimate the CLTV of this brand as a payment processing customer, and come into the first sales call with a sense of what kind of product offering and rates will be appropriate for and attractive to this customer.